The 2024 Ultimate Bi-weekly Savings Plan For Low Income

Keeping it simple with this biweekly savings plan for low income earners. See how to create a savings plan of your own with our digital planner and printables.

Ah, savings – the financial equivalent of eating your vegetables. You know it's good for you, but who wants to do that when there's a world of spending opportunities out there? (I mean, have you seen the latest gadgets?) But fear not, dear reader, for I bring you the "2024 Ultimate Bi-weekly Savings Plan for Beginners", a guide so straightforward even your pet goldfish could probably give it a go (not recommended, though; they're notoriously bad with money).

Now, let's get one thing straight: this isn't your grandma's savings plan. Oh no, we're in 2024, and just like our phones and cars, savings plans have gotten a sleek upgrade. This Bi-weekly wonder is designed for the modern human, who juggles a myriad of expenses and still dreams of saving enough to not eat ramen every day post-retirement (though let's be honest, ramen is amazing).

Here's the deal: we'll break down the art of saving into manageable chunks. Think of it like a financial workout plan, but instead of squats and lunges, you're flexing your money-saving muscles.

What is a Bi-weekly Savings Plan?

A bi-weekly savings plan is a strategy for saving money that involves making deposits into a savings account every two weeks, instead of once a month or less

A bi-weekly savings plan, in its most basic form, is like playing a slow and steady game of financial Tetris. Instead of dropping blocks, you're dropping dollars into your savings account every two weeks. This approach is tailor-made for those who receive their paycheck on a Bi-weekly basis (which, let's be honest, is a lot of us).

Think of it as setting up a mini savings goal every two weeks. It's less daunting than staring down the barrel of an annual savings target. Imagine trying to eat a whole cake in one sitting (not recommended, by the way) versus savoring a slice every now and then. The Bi-weekly plan is the latter – a slice-by-slice approach to saving.

This method also aligns beautifully with your regular income flow, making it feel less like a financial ambush and more like a smooth part of your routine. In the grand scheme of things, it's a simple yet effective way to build savings without feeling overwhelmed.

How Does a Bi-weekly Savings Challenge Work?

Bi-weekly savings challenges let you build momentum by starting small (like $5), then steadily increasing your savings every two weeks, either by a fixed amount or percentage. Popular versions like the "$1-$26 challenge" or "52-week challenge" offer structured plans, but you can customize the duration and increments to fit your budget and goals.

The Bi-weekly savings challenge is the financial world's version of a fitness challenge, but instead of getting abs, you're building a healthier bank account. It starts with setting a realistic savings target for each paycheck.

Example of a bi-weekly savings challenge

Here's where it gets interesting (and a bit fun, if you're into this sort of thing). You can either save a fixed amount every two weeks or, if you're feeling adventurous, increase the amount incrementally with each paycheck. It's like leveling up in a game, but with your savings account.

Let's paint a picture with numbers: you could start by saving $20 from your first paycheck, then $40 from the next, and so on. By the end of the year, you're not only saving more consistently but also progressively more. It's like giving yourself a mini-promotion every two weeks!

The beauty of this challenge lies in its flexibility. You can adjust the amounts based on your personal financial situation and goals. And if life throws you a curveball (as it often does), you can always tweak your plan. It's about making regular savings a habit, and not so much about the specific amounts.

In essence, the Bi-weekly savings challenge is about turning saving money from a chore into a rewarding habit. It's about progress, not perfection. And remember, the real victory is in the habit you're building, not just the dollars you're saving.

5 Steps to creating a Bi-weekly savings plan with low income

Navigating the waters of savings on a low income can seem as challenging as crossing an ocean in a rowboat. But fear not! With the right approach, even the tightest budget can sprout savings. Here are the steps tailored specifically for low-income earners:

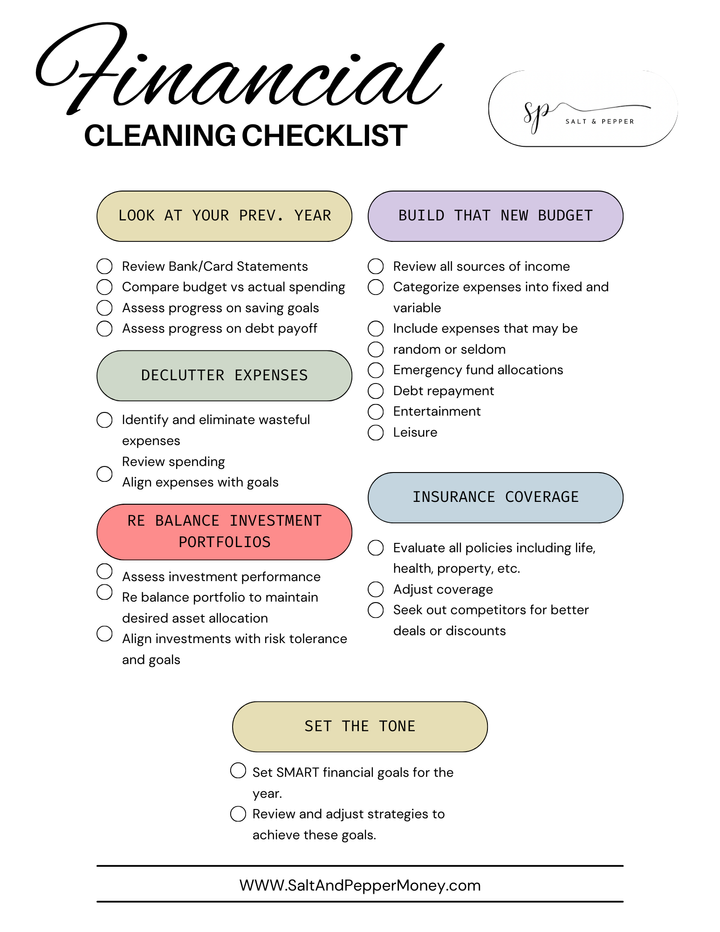

- Examine Your Expenses with a Microscope: First things first, get a crystal-clear picture of where every penny goes. This means tracking all expenses, no matter how small. (Read 'How to Budget Money for Beginners'- if you need help.) The goal here is to identify any non-essential expenses that can be reduced or eliminated. Think of it like trimming the sails of your financial ship to make it more streamlined.

- Set an Achievable Savings Goal: When income is limited, setting realistic goals is crucial. This might mean starting with very small amounts. Remember, the journey of a thousand miles begins with a single step. Your goal should be something that doesn't stretch your finances too thin.

- Choose a Modest Savings Amount: Decide on an amount that you can comfortably set aside each paycheck. It might be the cost of a couple of coffees or a takeout meal. Small amounts, consistently saved, can surprisingly accumulate over time.

- Select your tracking tool: We offer two free options to help you track your bi-weekly savings. The online version is a G-sheet that you can modify and it saves automatically. Or if you’re more of a pen and paper family (I hear ya) you can download our printable tracker instead. Scroll down to access either or both!

- Seek Out Additional Savings Opportunities: Look for ways to increase your income or decrease your expenses. This could be anything from taking on a part-time job, selling unused items, or utilizing community resources and assistance programs.

By following these steps, low-income earners can develop a savings plan that fits within their means. It's about making the most of what you have, however modest it may be, and slowly building towards a more secure financial future. Remember, every small step counts!

Example of a savings plan + Digital Download

Sign up below to download!

Bi-weekly savings plan: 4 tips to to help you stay on track

- Reward Yourself Within Reason: It's important to acknowledge your efforts. Set aside a tiny portion of your savings for a small treat once in a while. This will help keep you motivated and remind you that saving money isn't just about sacrifice.

- Stay Adaptable and Patient: With a limited income, the path to saving can have more twists and turns. Be patient with your progress and adaptable to changing circumstances. Sometimes, you might save less than planned, and that's okay.

- Utilize Automated Savings Tools: Many banks offer automated savings plans where you can transfer a small amount from your checking to your savings account automatically. These tools can be incredibly useful for staying consistent with your savings, especially when the amount is small.

- Regularly Review Your Finances: Periodically check in on your finances. This is crucial for low-income earners as it allows you to adjust your savings plan in line with any changes in your financial situation.

Comments ()