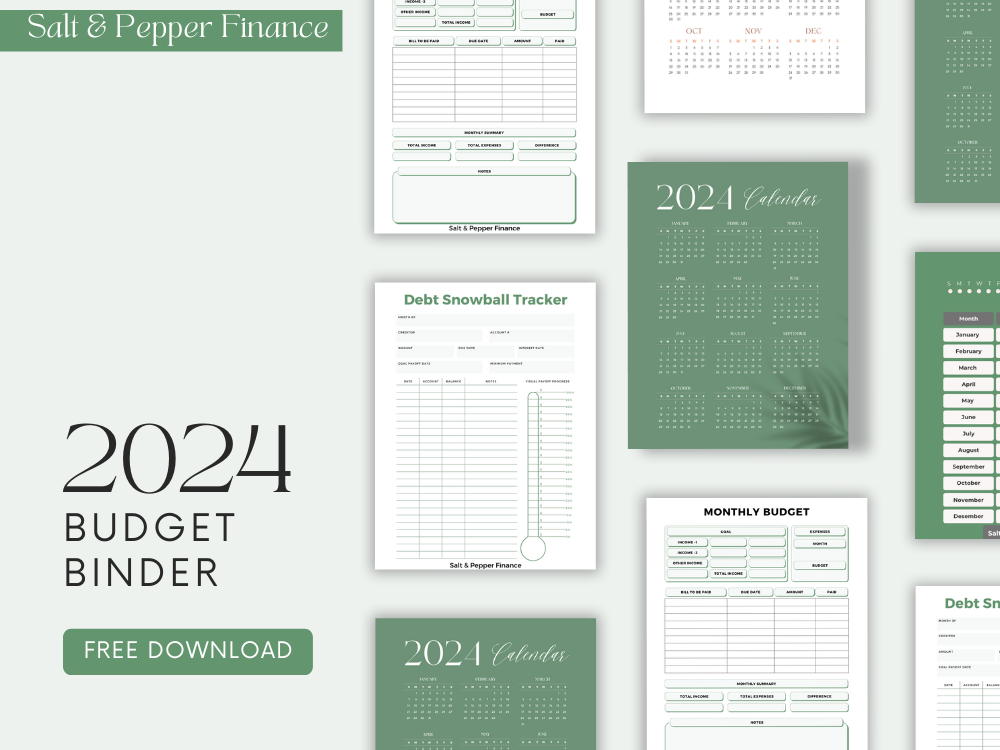

2024 Budget Binder + Free Printables

Looking to start off 2024 with some accountability? Print our free budget binder and start the new year off right with getting your finances in order.

Budgeting works better for some with visual aids and trackers. Especially for those who are newbies. One popular option is a budget binder, a simple yet effective tool for organizing your financial life.

In this guide, we'll explore how to set up and maintain a budget binder, tailor it to your unique financial situation, and use it to track your income, expenses, savings, and financial goals.

Plus, you can print out our sheets for free and create your own budget binder today. It’s perfect for everyone from beginners to experienced budgeters, a budget binder can help you gain control over your finances and move closer to achieving your financial aspirations.

What is a Budget Binder?

A budget binder is your financial command center. It's more than just a collection of papers; it's a curated tool that summarizes your entire financial narrative. At its core, a budget binder is a physical (or digital) folder where you systematically track, manage, and plan all aspects of your personal finances.

But also:

It's a Clear Visual of Your Financial Health

Imagine being able to open a binder and see exactly where you stand financially. That's the power of a budget binder. It breaks down your financial life into digestible, manageable segments, offering a crystal-clear picture of your income, expenses, savings, and debts.

It's a Customizable Tool

The beauty of a budget binder lies in its adaptability. It can be as simple or as detailed as you need it to be. Tailored to your unique financial situation, it evolves with you as your financial goals and circumstances change.

It's an Accountability Partner

Your budget binder serves as a tangible reminder of your financial goals and responsibilities. It keeps you accountable, ensuring that you're not just aware of your financial habits but are actively working to improve them.

It's a Planning Guide

Beyond tracking your current financial situation, a budget binder helps in forecasting and planning for the future. Whether it’s saving for a vacation, preparing for retirement, or setting aside funds for an emergency, your budget binder is your roadmap to achieving these objectives.

In essence, a budget binder is more than just a tool for organization. It's a living document that reflects your financial journey, helping you to make informed decisions, stay on track with your goals, and ultimately, gain financial freedom.

Who is a Budget Binder Best For?

A budget binder is an incredibly versatile tool, suitable for a wide range of individuals, regardless of their financial status or expertise. It's especially beneficial for:

1. Budgeting Beginners

For those just starting their journey into personal finance, a budget binder is an invaluable guide. It simplifies the complex world of finances into manageable segments, making it easier to understand and track income, expenses, and savings goals.

2. Busy Professionals

Professionals juggling work and personal life can find a budget binder particularly useful. It helps in keeping financial records organized and readily accessible, saving time and reducing the stress of managing multiple financial obligations.

3. Families

For family heads or partners managing household finances, a budget binder offers a structured way to oversee all family-related expenses and savings plans. It's a practical tool for teaching kids about financial responsibility and for ensuring transparency in family budgeting.

4. Freelancers and Entrepreneurs

Individuals with fluctuating income, such as freelancers and entrepreneurs, benefit greatly from a budget binder. It helps them track irregular income streams, manage business expenses, and plan for lean periods.

5. Financial Enthusiasts and Planners

Those who love diving deep into personal finance will find the budget binder an effective tool for detailed financial analysis and planning. It's perfect for setting complex financial goals, tracking investments, and strategizing for future financial growth.

6. Anyone Aiming for Financial Discipline

Essentially, anyone striving for financial discipline, clarity, and independence can benefit from a budget binder. Whether you're saving for a specific goal, trying to reduce debt, or simply aiming to get a better handle on your finances, a budget binder can be tailored to meet those needs.

In summary, a budget binder is not just for a select few; it's a universal tool designed for anyone eager to take control of their financial destiny. It's about making finance management accessible, understandable, and effective for all.

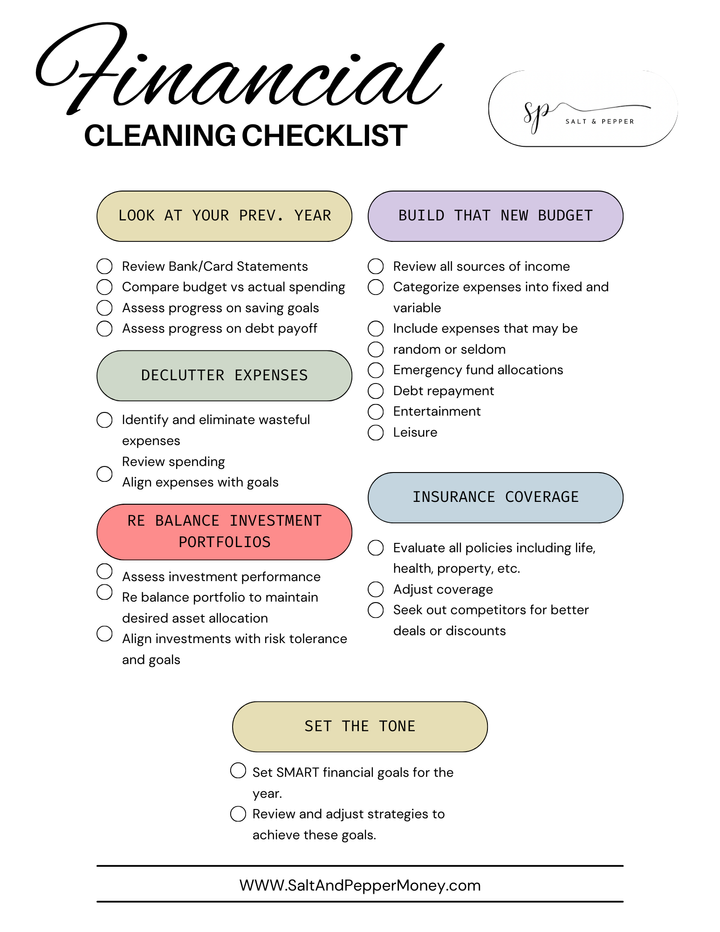

What 3 things should a good budget binder include?

So, what exactly goes into this magical binder? Three core elements form its backbone:

- Income Tracker: This is where you record every penny that comes your way. It's not just about your salary; think side hustles, freelance gigs, and even that occasional gift from grandma.

- Expense Sheets: Every dollar spent should be accounted for. Whether it's that morning coffee or monthly rent, track it diligently.

- Savings Goals: Here's where dreams start to take shape. Are you saving for a new car, a dream vacation, or just a rainy day? This section helps you visualize and achieve these goals.

How to Easily Organize a Money Binder in 7 Steps

Organizing a money binder effectively is key to ensuring it serves its purpose of simplifying and streamlining your financial management. Here are steps to create a well-organized, efficient money binder:

1. Choose the Right Binder

Start with selecting a binder that suits your needs. It should be durable and have enough sections or dividers to categorize your financial information. Consider the size - not too bulky but spacious enough to accommodate your documents.

2. Set Up Dividers for Major Categories

Use dividers to separate major financial categories. Common sections include:

- Income: Where you track all sources of income.

- Expenses: For listing your monthly and occasional expenses.

- Savings: To monitor your savings goals and progress.

- Debts: If applicable, to keep an eye on what you owe and your repayment plans.

- Investments: To track stocks, bonds, or other investments, if any.

3. Use Clear Labels

Label each section clearly. This not only makes it easier to find what you need but also helps in maintaining the organization. You can use handwritten labels, printed labels, or even color-coded tabs.

4. Incorporate Budget Sheets and Trackers (Use Ours Free!)

Insert budget sheets and trackers in each section. You can use pre-made templates or create custom ones tailored to your needs. These should include columns or spaces to fill in relevant data regularly.

5. Designate a Section for Receipts and Bills

Have a pocket or a section where you can store receipts, bills, and other financial documents. This ensures that all your financial records are in one place and can be easily referenced or updated in your trackers.

6. Include a Calendar or Financial Planner

Integrate a calendar or financial planner to track bill due dates, salary dates, savings milestones, and other important financial events. This helps in planning ahead and ensures you don't miss any crucial financial deadlines.

7. Regular Review and Update

Set a regular schedule for updating your binder. Consistently updating the binder ensures it accurately reflects your current financial situation, which is vital for effective financial planning.

Remember, the money binder should work for you. Feel free to add, remove, or adjust sections as your financial situation changes. The goal is to make it as helpful and intuitive as possible for your unique financial needs.

By following these steps, your money binder will become a well-organized, functional tool that provides clarity on your financial status, helps in making informed decisions, and guides you towards your financial goals.

Is A Budget Binder Worth It?

Is a budget binder worth it? Absolutely. Think of it as an investment in your financial health. By laying out your financial landscape, you gain clarity, control, and a heightened sense of financial awareness.

How Do I Make My Own Budget Binder?

Ready to dive in and create your budget binder? Here’s a step-by-step guide:

Step 1: Gather Your Materials

You'll need a binder, dividers, a hole punch, and printable sheets (don’t worry, I’ve got you covered with free printables). Choose a binder that resonates with your style – make it something you’ll love to use. Here’s a few I think would work well

Step 2: Print and Punch

Download the free printables (at the end of this post!) and print them out. Use a hole punch to get them binder-ready. These sheets will form the core of your budget binder.

Step 3: Customize Your Categories

Divide your binder into sections that reflect your financial life. Common categories include Income, Expenses, Savings, Debts, and Goals. Feel free to get creative and add sections like ‘Holiday Budget’ or ‘Emergency Fund’.

Step 4: Fill in Your Data

Now, start filling in your data. Be honest and thorough. This is about getting a real picture of your financial health.

Set a regular schedule to update and review your binder. Weekly, bi-weekly, or monthly – find what rhythm works best for you.

Budget Binder Alternatives to Consider

Another option if you’re looking to gamify your savings and debt pay off is to try the cash envelope system. Here’s how it works on a high level:

- Allocate Budget Categories: First, identify the main categories where you spend money each month, such as groceries, dining out, entertainment, transportation, and bills.

- Determine Budget Amounts: Decide how much money you'll allocate to each category based on your monthly budget.

- Create Envelopes for Each Category: Label an envelope for each spending category. You can use physical envelopes or digital equivalents if you prefer not to use cash.

- Distribute Cash: After receiving your income, distribute the designated budgeted amount of cash into each corresponding envelope.

- Spend from Envelopes: When you need to make a purchase, use the money from the appropriate envelope. This helps you visualize and stick to your budget limits.

- Monitor and Adjust: At the end of the month, review the amount spent in each category. Any leftover cash can be saved, or reallocated to other categories or debt repayment.

This system effectively gamifies the process of budgeting and saving, making it more engaging and interactive. It's a great way to maintain discipline in spending and achieve your financial goals. Looking for a great cash envelope book instead of DIY? I’ll link to one I found on Amazon below.

Tips for Budget Binder Success

- Be Consistent: The key to a successful budget binder is regular maintenance. Set aside time each week to update your information.

- Reflect and Adjust: Use your binder to reflect on your spending habits and adjust as needed. Found yourself overspending in one category? Time for a budget tweak.

- Celebrate Milestones: Reached a savings goal? Celebrate it! Acknowledging your financial wins, no matter how small, boosts motivation.

- Seek Feedback: Don’t hesitate to ask for advice or share your budgeting journey with others. Sometimes, a fresh perspective can be incredibly valuable.

- Stay Flexible: Your financial situation will evolve, and so should your budget binder. Don’t be afraid to make changes as your life changes.

Disclaimer

Please note that some of the products mentioned in this guide may be linked through affiliate programs. This means I may earn a commission if you decide to make a purchase through these links, at no additional cost to you. Your support helps me continue to provide valuable content, and I thank you for it.

Comments ()