Discover the Key Components of Successful Budgeting

Explore the critical components of successful budgeting, from understanding its significance to setting realistic goals. This article delves into categorizing expenses, creating a comprehensive plan, and regularly adjusting your budget, aiding you in achieving financial stability.

Budgeting is a vital part of financial planning. It gives you a clear understanding of your income and expenses, enabling you to make informed financial decisions. In this article, we'll be discussing the key components of successful budgeting, including why it is important, how to set realistic financial goals, how to categorize expenses, how to create a comprehensive budget plan, and how to monitor and adjust your budget over time.

Understanding the Importance of Budgeting

Before diving into the practical aspects of budgeting, it's essential to understand why budgeting matters. For starters, budgeting allows you to take control of your finances, rather than leaving them to chance.

With a budget, you can track your income and expenses, identify areas of overspending, and plan for future financial goals. This means you can make informed decisions about where your money goes and avoid falling into debt or experiencing financial stress.

But budgeting isn't just about managing your day-to-day expenses. It also plays a crucial role in long-term financial planning. By creating and sticking to a budget, you can ensure that you are spending within your means and living within your financial limits.

The role of budgeting in financial planning

Financial planning is all about working towards your long-term financial goals. Whether you want to build an emergency fund, save for a down payment on a home, or invest in retirement funds, budgeting is an essential part of the process.

When you create a budget, you can identify areas where you can cut back on expenses and redirect that money towards your financial goals. This means you can make progress towards your goals without sacrificing your current quality of life.

Having a budget also allows you to plan for unexpected expenses or changes in income. By setting aside money for emergencies or unexpected expenses, you can avoid falling into debt or having to dip into your savings.

Benefits of maintaining a budget

Maintaining a budget has several benefits beyond just financial security. One of the most significant benefits is that it can help you avoid debt. When you have a clear understanding of your income and expenses, you can avoid overspending and falling into debt.

Managing your finances through budgeting can also reduce financial stress. Money is one of the most significant sources of stress for many people, but having a budget can help alleviate that stress by providing a clear plan for your finances.

Another benefit of maintaining a budget is that it can improve your credit score. By paying your bills on time and avoiding missed payments, you can improve your credit score over time. This can make it easier to get approved for loans or credit cards in the future.

Finally, a budget can improve your communication and spending habits with your significant other, family, or roommate. When everyone is aware of the financial situation and working together to achieve financial goals, it can improve relationships and reduce conflicts related to money.

Setting Realistic Financial Goals

Once you understand the importance of budgeting, it's essential to set realistic financial goals that align with your values and priorities. Start by setting short-term goals, such as reducing your restaurant expenses or paying off a credit card balance, that can be completed in the next few months. Then, think about long-term goals, such as saving for a down payment on a home or paying off student loans, that will take more time and ongoing budgeting.

Short-term vs. long-term goals

Short-term goals are immediate and focus on changing your spending and saving habits to achieve a specific outcome. For example, you may set a short-term goal to reduce your restaurant expenses by cooking more meals at home. This goal can be achieved within a few weeks or months. In contrast, long-term goals are more significant and require ongoing commitment and effort to achieve. For instance, saving for a down payment on a home may take several years of consistent saving and budgeting.

It's important to balance both types of goals to ensure that your budget reflects your priorities and aligns with your lifestyle. Short-term goals can help you stay motivated and see progress, while long-term goals provide a sense of direction and purpose.

Aligning goals with your financial priorities

When setting financial goals, consider your values and priorities. For example, if you value travel, allocating funds towards a travel budget may be more important than other items like dining out. On the other hand, if you prioritize paying off debt, you may need to cut back on discretionary spending to free up funds for debt repayment.

It's important to note that budgets need to be flexible to accommodate changes in lifestyle and unexpected expenses. So, while it's essential to have a budget plan, staying fixated on the plan may not be realistic in the long run. For example, if you experience a sudden job loss or unexpected medical expenses, you may need to adjust your budget to accommodate these changes.

Remember, setting realistic financial goals is an ongoing process that requires regular review and adjustment. As your priorities and circumstances change, your financial goals may need to be revised to reflect these changes. By staying flexible and committed to your goals, you can achieve financial stability and peace of mind.

Identifying and Categorizing Expenses

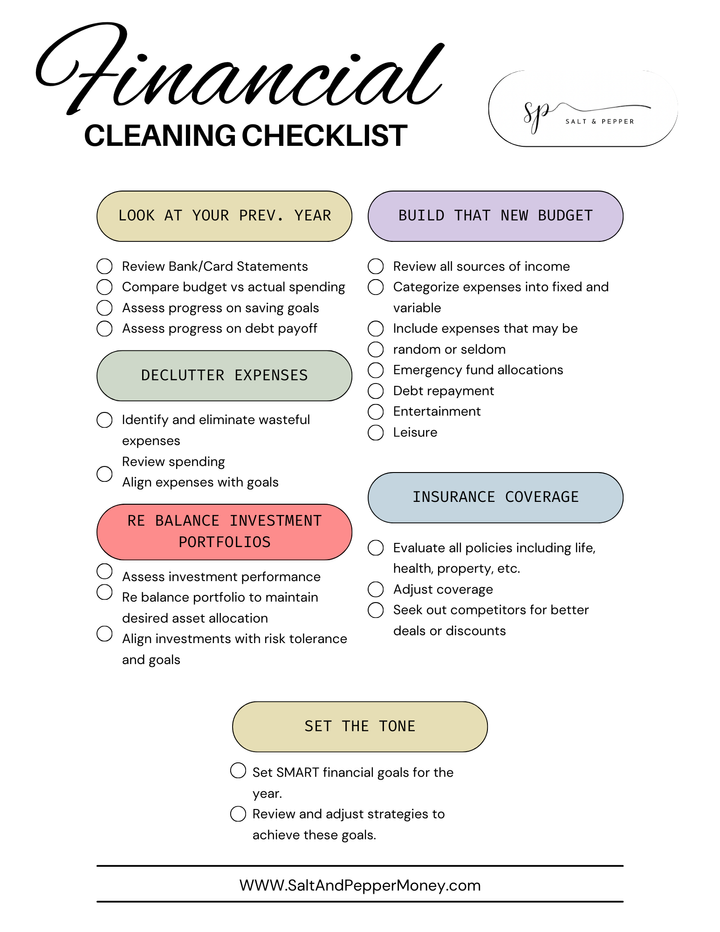

Creating a budget is an important step towards financial stability. After setting realistic goals, the next step is identifying and categorizing your expenses. This will help you understand where your money is going and allow you to make informed decisions about your spending.

Start by recognizing essential expenses like rent, utilities, groceries, car payments, and insurance. These are expenses that you cannot avoid and are necessary for daily living. It is important to prioritize these expenses in your budget to ensure that you have enough money to cover them each month.

Once you have identified your essential expenses, factor in non-essential expenses like entertainment, dining out, subscriptions, and donations. These are expenses that you can live without or reduce if necessary. While it is important to enjoy life and have fun, it is equally important to be mindful of your spending habits.

Fixed vs. Variable Expenses

Expenses can be further broken down into two categories, fixed and variable expenses. Fixed expenses do not change, such as rent, car payments, or subscription services. These are expenses that you can plan for each month and are typically the same amount. Variable expenses fluctuate, such as groceries, entertainment expenses, or gas. These expenses can be more difficult to plan for since they can vary from month to month.

By understanding these two categories, you can prioritize your budget and determine where you can cut back, where you need to stay on track, and where you can allocate additional funds. For example, if you have a fixed expense like rent, you know that you need to allocate that amount each month. However, if you have a variable expense like groceries, you may need to adjust your budget based on how much you spend each month.

Essential vs. Non-essential Expenses

Essential expenses are expenses that are necessary for daily living, such as groceries or rent. These are expenses that you cannot avoid and should be prioritized in your budget. Non-essential expenses are items that you can live without or reduce, such as dining out or shopping for clothes. While it is important to enjoy life and have fun, it is equally important to be mindful of your spending habits.

By understanding the difference between these two categories, you can allocate funds appropriately and ensure that you have enough saved for essential expenses before splurging on non-essential ones. For example, if you have a set amount of money each month for entertainment expenses, you may need to adjust your budget if you have a large essential expense that month.

Overall, identifying and categorizing your expenses is an important step towards financial stability. By understanding your spending habits, you can make informed decisions about your money and work towards achieving your financial goals.

Creating a Comprehensive Budget Plan

Once you have identified your expenses, it's time to create a comprehensive budgeting plan. Review your income and expenses, determine how much you can save, allocate funds for investments, and create a systematic plan for paying off debt.

Choosing the right budgeting method

The right budgeting method will depend on your unique financial situation and lifestyle. However, two budgeting methods are commonly used - the 50/30/20 budgeting rule and zero-based budgeting. The 50/30/20 rule allocates 50% of your income to essential expenses, 30% to non-essential expenses, and 20% towards investments and debt payments. Zero-based budgeting starts from scratch each month and requires you to track every expense and ensure that your income is equal to expenses.

Allocating funds to different expense categories

After selecting a budgeting method, allocate funds to different expense categories, based on priority. Ensure that you have enough funds for essential expenses and allocate additional funds to more important goals. Review your budget plan regularly and ensure that you are staying within your set limits.

Monitoring and Adjusting Your Budget

Finally, it's critical to monitor and adjust your budget regularly. Review your budget plan at least once a month, track your spending, and ensure that you are sticking to your financial goals. If necessary, adjust your expenses, limit unnecessary spending, and remain realistic about the budget plan. Depending on your current financial situation, it's essential to plan for foreseeable expenses and account for potential emergencies that you may encounter.

Regularly reviewing your budget

Regularly reviewing your budget enables you to identify areas for improvement and ensure that you are on track to meet your financial goals. Additionally, it's an opportunity for you to update your budget based on new and unexpected expenses, changes in income, life events, or new goals.

Adapting your budget to changing circumstances

Your financial situation will change over time, so it's critical to adapt your budget accordingly. If you experience a loss of income, prioritize your essential expenses, and adjust your non-essential expenses accordingly. Similarly, if you receive an unexpected influx of income, allocate the funds to high priority goals, such as paying off debt or building an emergency fund. The key is to ensure that your budget is flexible, adaptable, and aligned with your current financial situation.

Salt & Pepper's Takeaways

In conclusion, budgeting is fundamental to financial planning and is essential for achieving long-term financial goals. Understanding why budgeting matters and setting realistic financial goals is just the beginning. Identifying and categorizing your expenses and creating a comprehensive budget plan requires time, effort, and dedication, as does monitoring and adjusting your budget regularly. By following the key components of successful budgeting outlined in this article, you can take control of your finances, reduce financial stress, and work towards a more secure financial future.

Comments ()