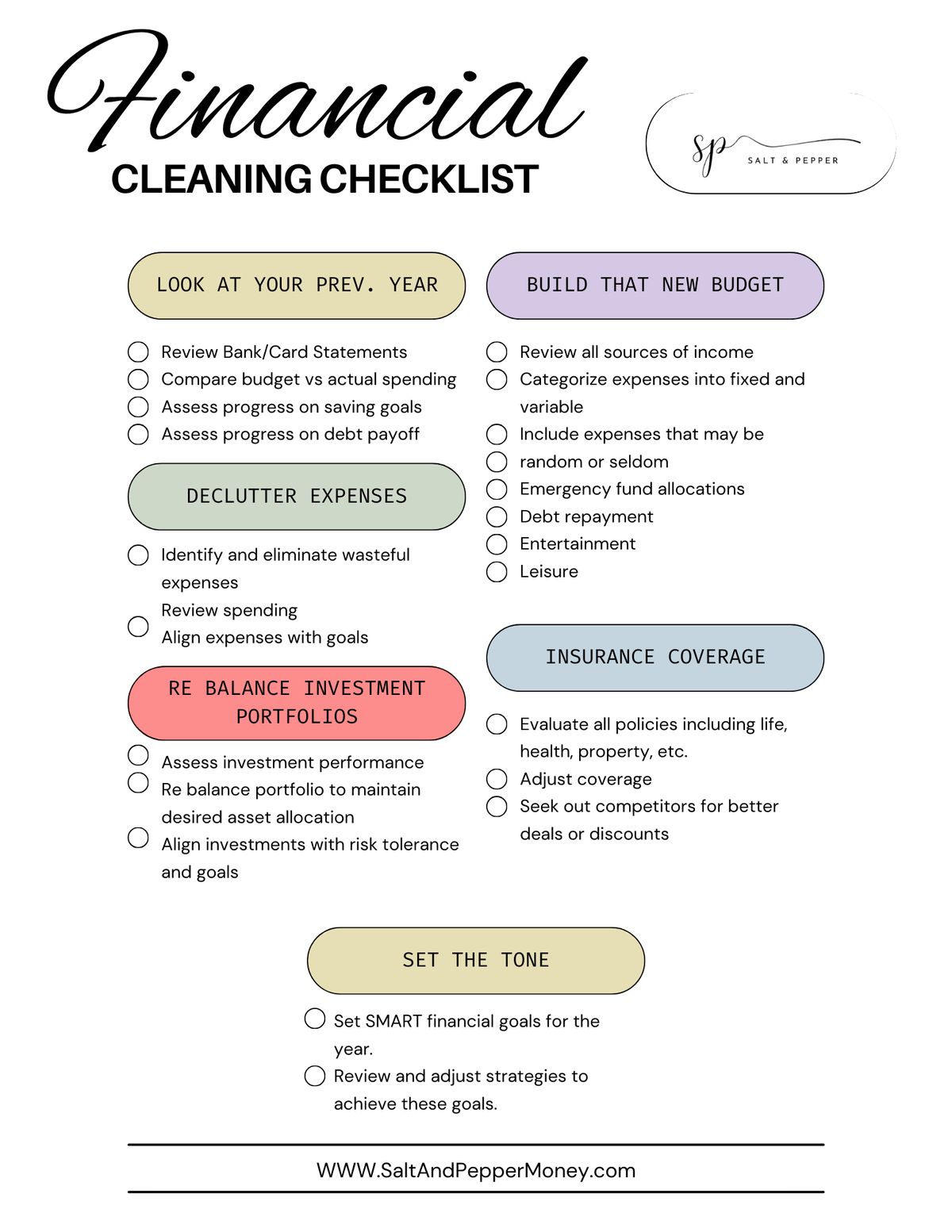

Easy Financial Spring Cleaning Checklist

Time to dust off your personal finances for the new year. Here is an easy to follow financial spring cleaning checklist.

I procrastinated until December 30th to FINALLY finish up my to-dos before ringing in the new year.

I finally cleaned out my pantry, organized the garage, and sorted the baby’s clothes. It was a lot for one day (considering I had all year to do it), but when I was finished I felt an overwhelming sense of accomplishment. Like I was ready to see the new year come with its wave of promise, hope and potential.

Which got me thinking? I wonder if people do this for their finances?--Like a “financial spring cleaning”.

🤔🤔🤔

Here we go.

Table of Contents:

- Take assessment

- Build a new budget

- Eliminate expenses

- Rebalance portfolio

- Update your insurance coverage

- Automating your finances

- Setting new financial goals

- Credit score boost

- Plan/prep for tax season

Take Assessment of Your Previous Year

After the new year has been rung in, let the after burn of fireworks be a signal to look back at your financial journey over the past year. The goal here is simple yet vital: identify what slipped through the cracks. Often, small leaks can lead to a significant drain on your resources over time.

Finding What Slipped Through the Cracks

Best believe SOMETHING ALWAYS SLIPS.

- Review Bank Statements and Credit Card Reports: Start by combing through your bank and credit card statements from the past year. Look for recurring subscriptions you no longer use, bank fees you weren't aware of, or any unusual spending patterns.

- Examine Your Budget vs. Actual Spending: Compare your budgeted expenses with the actual amounts spent. This helps in pinpointing areas where you consistently overspent. Maybe it was those extra takeout meals or impulse buys.

- Assess Your Savings Goals: Did you hit your saving targets? If not, try to understand why. Was it due to unexpected expenses, or did you perhaps set an unrealistic goal?

- Audit Your Investments: Check how your investments have performed. Are there any under performers or investments that no longer align with your risk tolerance or goals?

Making Note of the Issues

Once you've identified the areas where things didn't go as planned, the next step is documentation. Write down these insights. This could include how much you overspent on dining out, the total cost of unused subscriptions, or the performance gap in your investments.

Why It's Important

- Prevents Repeat Mistakes: Recognizing and acknowledging past financial slips helps in avoiding them in the future.

- Informs Future Decisions: This exercise provides valuable data for making more informed and realistic financial decisions.

- Helps Refine Your Budget: Understanding past pitfalls allows you to adjust your budget in a more effective way.

In short, a thorough review of the past year is a cornerstone of financial spring cleaning. It's about learning from the past to make smarter financial decisions for the future.

Building a New, Fresh Budget

With the insights from your previous year's financial review in hand, it's time to build a fresh budget. This isn't just about adjusting numbers; it's about creating a financial plan that reflects your current goals, needs, and circumstances.

Setting Up Your New Budget

- Income Assessment: Start by accurately assessing all your income sources. This includes your regular salary, any side hustles, dividends, interest, and occasional incomes like bonuses.

- Fixed vs. Variable Expenses: Categorize your expenses into fixed (like rent, mortgage, insurance) and variable (like groceries, entertainment). This helps in understanding where you have room for adjustments.

- Include Seldom-Remembered Expenses: Don’t forget annual or semi-annual expenses such as property taxes, car maintenance, or insurance premiums. These can be substantial and should be factored into your monthly budget by dividing their total cost by 12.

- Emergency Fund Allocation: Make sure to include a line for emergency savings. It’s crucial to build or maintain an emergency fund that can cover at least 3-6 months of living expenses.

- Consider Debt Repayments: If you have loans or credit card debts, prioritize their repayment. Consider using strategies like the debt snowball or avalanche methods.

- Plan for Retirement and Investments: Allocate a portion of your income towards retirement savings and investments. This is critical for long-term financial health.

- Entertainment and Leisure: It's important to budget for fun as well. Allotting a specific amount for entertainment ensures you enjoy the present while being mindful of your financial goals.

The Intricacies Often Missed

Successful budgeting are also more than what's included. They also need to be flexible.

- Adjust for Life Changes: Any significant life changes (like a job change, marriage, or relocation) should be reflected in your new budget.

- Flexibility: Your budget should have some flexibility to account for unexpected expenses or changes in income.

- Periodic Reviews: Set regular intervals (like monthly or quarterly) to review and adjust your budget as needed.

- Goal-Oriented Budgeting: Align your budget with your short-term and long-term financial goals. This gives your budgeting exercise a purpose beyond just tracking expenses.

Why It's Important

Creating a new budget with these elements helps in:

- Avoiding Financial Stress: A well-planned budget prevents last-minute scrambles for bill payments or unforeseen expenses.

- Achieving Financial Goals: Whether it's buying a house, saving for a vacation, or preparing for retirement, a detailed budget is your roadmap.

- Maintaining Financial Discipline: A comprehensive budget keeps your spending in check and encourages savings and investment habits.

3. De-cluttering Your Expenses

Spring is the perfect time to sift through your expenses and weed out the non-essentials. Start by identifying subscriptions or memberships you no longer use or need - these are often small but recurring costs that add up over time.

Examine your discretionary spending habits, like frequent dining out or impulsive online shopping, and consider setting limits or finding more budget-friendly alternatives.

Don’t overlook periodic expenses, such as annual subscriptions or insurance premiums, which can be significant. This process isn’t just about cutting costs; it’s about making sure that every dollar you spend aligns with your current financial goals and brings real value to your life. By de-cluttering your expenses, you pave the way for a more streamlined and focused approach to your finances.

4. Revisiting and Re-balancing Your Investment Portfolio

Spring cleaning isn't just for your home; it's also a crucial time to revisit your investment portfolio. Assess the performance of your current investments against your financial goals and risk tolerance.

Market dynamics can shift the weightings of your assets, making it necessary to re balance to maintain your desired asset allocation. This might involve selling some investments and buying others to get back on track. Remember, re balancing is key to managing risk and ensuring your investments stay aligned with your long-term objectives. Regularly updating your portfolio is a proactive step towards a healthier financial future.

5. Reviewing and Updating Insurance Coverage

As life evolves, so should your insurance coverage. Take this time to review your current insurance policies, be it life, health, home, or auto insurance. Ensure that the coverage is still adequate for your current life situation.

Significant life events like marriage, the birth of a child, or purchasing a new home can substantially change your insurance needs. It's also wise to shop around periodically to see if you can get better rates or more comprehensive coverage. Regularly updating your insurance coverage is not just a financial safety net but a crucial aspect of sound financial planning.

6. Streamlining and Automating Your Finances

In the digital age, automating your finances is like setting a smart thermostat for your money. Automate bill payments to ensure you never miss a due date, avoiding late fees and potential hits to your credit score.

Set up automatic transfers to your savings account or investments right after payday; it’s the easiest way to save without thinking about it. Automation helps maintain financial discipline, reduces the stress of manual management, and ensures your money is being allocated as planned. Embrace technology to make your financial life smoother and more efficient.

7. Setting New Financial Goals

With a fresh year ahead, it’s time to set new financial goals. These should be specific, measurable, achievable, relevant, and time-bound (SMART). Maybe you want to save a certain amount for a dream vacation, pay off a specific debt within the year, or reach a new milestone in your investment portfolio. Remember, the key to achieving financial goals is not just setting them but also regularly reviewing and adjusting your strategies to stay on track. Let your goals be your financial compass, guiding your decisions throughout the year.

8.Enhancing Your Credit Score

Your credit score is like a financial passport; it opens doors to new opportunities. Start by regularly reviewing your credit reports for any inaccuracies. Focus on paying down outstanding debts, especially high-interest credit cards. Aim to keep your credit utilization – the ratio of your credit card balances to your credit limits – below 30%. Paying bills on time is crucial, as payment history is a significant factor in credit scoring. Remember, a strong credit score can save you money on interest rates and give you leverage in financial negotiations.

9. Planning for Tax Season

Tax season can be smooth sailing with the right preparation. Start early by gathering all necessary documents: W-2s, 1099s, receipts for deductions, and previous year’s tax return. Understand the latest tax laws, which could affect deductions or credits you’re eligible for.

If you anticipate a refund, plan how you’ll use it effectively – perhaps paying down debt or boosting your emergency fund. Conversely, if you owe money, start planning how to cover that payment. Consider consulting with a tax professional if your situation is complex. Good tax planning can potentially save you money and prevent last-minute scrambling.

Comments ()