How to Budget Money for Beginners: The 6-Step Plan

Budgeting money isn't a secret but there is a secret to being successful at it- discipline. Here is a six-step plan to make it happen.

If you're anything like me, then you learned about budgeting the hard way. I used to think that having consistent spare cash from month to month was a sign that I should go buy a fancy car or a new set of golf clubs. I'd charge it all to my credit card, telling myself I could afford the monthly payments.

But soon enough, I found myself buried under at least $80k of debt, with no way to dig myself out because I had blown all my money on ridiculous things I thought I "needed."

Then one day, I stumbled upon a Dave Ramsey video that made me actually do the math on how long it would take me to pay off my debt by only making minimum payments. Let's just say, it scared the shit out of me.

So, this article hits close to home for me, and I hope my 6-step plan can help some of you before it's too late.

What is Budgeting?

Budgeting helps you keep track of your income, expenses, and savings goals, so you can make informed decisions about your money. Budgeting is like going on a diet, except instead of tracking calories, you're tracking your money. It's the process of creating a plan for your finances, so you don't end up broke and hungry at the end of the month.

It may not sound sexy, but trust me, it's a game-changer. With a budget, you'll have a better understanding of where your money is going and how you can allocate it to achieve your financial goals. So, if you want to take control of your finances and stop living paycheck to paycheck, budgeting is crucial.

Why is Budgeting Important?

Budgeting is important because it also helps you achieve your financial goals, whether that's paying off debt, saving for a down payment on a house, or planning for retirement. In short, budgeting is the foundation of financial stability and success.

And if you're still not convinced that budgeting is worth your time, let me tell you why it's so damn important. First of all, budgeting helps you avoid debt and overspending. When you have a plan in place, you're less likely to make impulse purchases or blow your entire paycheck on one shopping spree.

Plus, when you know exactly how much money you have coming in and going out, you can make smarter decisions about where to spend and save.

Need a budget outline to get you started? (For free btw 👀) We've got you. Click to download below.

6 Steps to Setting Up A Budget

I know, I know, the idea of budgeting might seem overwhelming or boring or both, but trust me, it's not as painful as stepping on one of your kid's legos. In fact, I've got a 6-step plan that will make setting up a budget a breeze. These six steps helped me create a budget that worked for my situation, so hopefully, it can do the same for you.

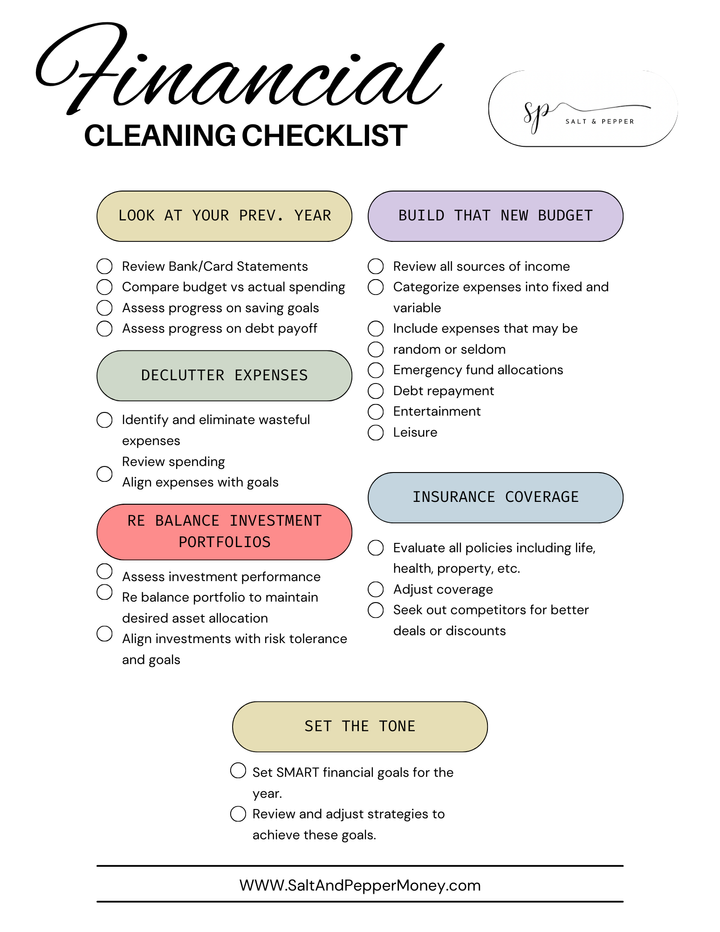

1.) Establish Your Financial Goals

Before you can create a budget, you need to know what you're working towards. That's where the first step comes in - establishing your financial goals. Do you want to pay off debt? Save for a down payment on a house? Build up your emergency fund?

Whatever it is, it's important to have a clear idea of what you want to achieve so you can make informed decisions about your money. Once you know your goals, you can start to prioritize them and create a plan to reach them.

2.) Calculate Your Income and Expenses

Alright, now that you've got your goals in mind, it's time to get down to the nitty-gritty of budgeting - calculating your income and expenses. This step might not be the most exciting, but it's crucial for creating a budget that actually works. (And the results may truly surprise you).

Start by tracking your income from all sources, including your job, side hustles, and any passive income you may have. Then, make a list of all your expenses, from rent and utilities to your daily latte and everything in between.

Be honest with yourself and make sure you're accounting for all your spending, even the small stuff. Once you have a clear picture of your income and expenses, you can move on to the next step and start making some decisions about how to allocate your money. Hope you’re good at math.

3.) Make a List of Monthly Bills and Payments

This step builds off step two but it’s a little different. Step two is simply finding out how much money you have coming in and going out every month – big-picture stuff. Step three is about tracking your monthly bills and payments that you are obligated for (fixed expenses) or things that you absolutely must make payments on such as your:

- Rent or mortgage

- Utilities

- Car Payment

- Childcare

- Insurance

- Personal loans

This step is important because it helps you prioritize your spending and avoid any surprises when bills come due. Once you have a list of your fixed expenses, you can start to see how much money you have left over for other things like paying a little extra on a credit card bill or student loan, etc.

4.) Set Aside Money for Emergency Funds

The fourth step in setting up your budget is to set aside money for emergency funds. This means having some cash stashed away for those unexpected expenses that always seem to pop up - like car repairs, medical bills, or sudden job loss.

Ideally, you should aim to have at least three to six months' worth of living expenses saved up in your emergency fund. But let’s be honest…most of us don’t have that luxury.

That being said, a good place to start is to stash away anywhere from $1,000 to $5,000. I’ve found this to be my happy medium and most of my “oh shit” moments typically fall within that price range.

5.) Track Your Spending Habits

Alright, it's time to tackle the fifth step in setting up your budget - tracking your spending habits. This step is all about getting a handle on where your money is going and identifying areas where you might be overspending.

By tracking your spending, you'll be able to see which expenses are necessary and which ones you can cut back on. Yes, that, unfortunately, means our creature comforts typically have to get the boot (daily Starbucks, new clothes, eating outside the house, etc.)

It sucks I know, but this isn’t a long-term thing, it’s simply a short-term necessity if you're truly trying to achieve your financial goals. You'll be surprised at how quickly those small expenses can add up.

For example, let’s say you hit Starbucks on your way to work every morning (5 days/week) and spend on average $5. That means you would spend $1,300/year on coffee and breakfast. Something that can be made at the house for pennies on the dollar.

6.) Decide How to Allocate Any Extra Money

You’ve made it to the sixth and final step. If you have successfully followed the steps above, then you should have some cash left over at the end of each month, now it’s time to decide what to do with it. Depending on where you’re at in your financial journey you may want to put it towards paying off credit card debt, student loan debt, or making extra mortgage payments.

Whatever you decide, make sure it aligns with your financial goals and priorities. It's okay to treat yourself every once in a while but don't let it derail your progress. Remember, the key to successful budgeting is finding the right balance between saving and spending.

Salt's Takeaways

There's a secret my wife and I happened upon when it comes to personal finance and financial success; budgeting, saving, and paying off debt are all about habit and discipline. It is uncomfortable at first, but most achievements don't come without challenge.

- Make a plan and stick to it

- Get comfortable with being uncomfortable

- It's a marathon, not a sprint

- Take it one day at a time

Comments ()