The Ultimate Guide to Successful Budgeting: Unlocking the 6 Key Components

What are some of the key components of successful budgeting? Here is the 6 you need to know and how to unlock them all.

So, you've decided to take control of your finances, and you're looking for the secret sauce to budgeting success. Well, you're in the right place!

In this ultimate guide, we'll explore the key components of successful budgeting that'll have you mastering your money game in no time. (You can thank us later.)

What are The Key Components to Successful Budgeting?

There are several components to achieving a successful personal budget:

- Setting SMART Financial Goals

- Accurate Income and Expense Tracking

- Realistic Budget Categories and Allocations

- The Magic of the Emergency Fund

- Consistent Budget Reviews

- Leveraging Budgeting Tools and Resources

Let's unpack each one of these below and discuss some tips and actionable advice for all of them.

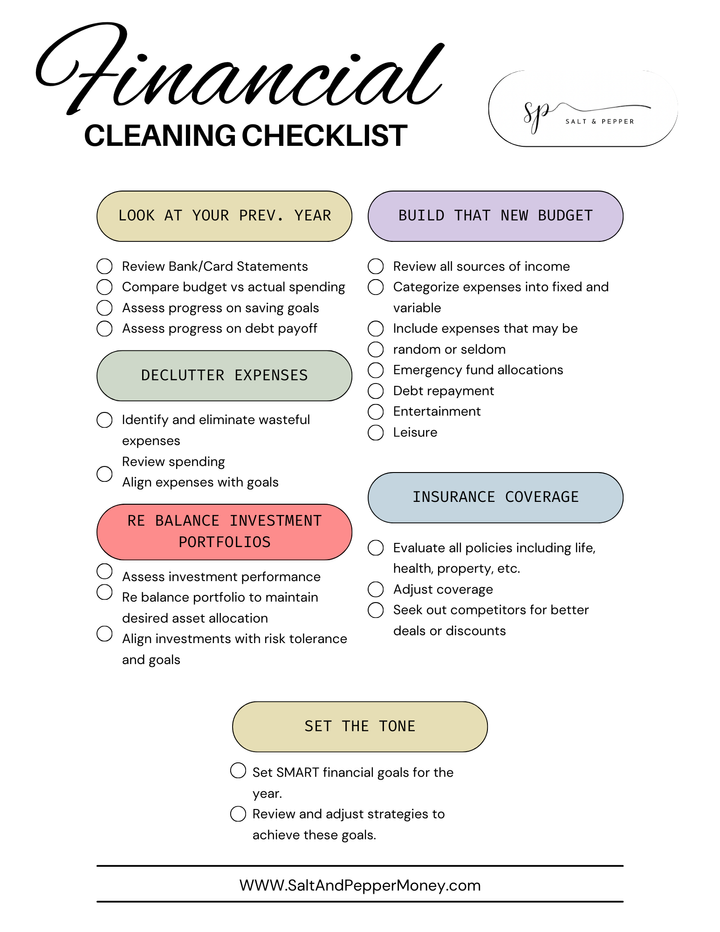

1. Setting SMART Financial Goals

Let's kick things off with the foundation of every successful budget: SMART financial goals. We're talking about goals that are:

- Specific

- Measurable

- Achievable

- Relevant

- Time-bound

You wouldn't take a road trip without a destination, right? (Unless you're a fan of getting lost.) The same applies to budgeting. Set clear goals to ensure you're heading in the right direction.

2. Accurate Income and Expense Tracking (It's Not Rocket Science!)

You can't manage what you don't measure. Accurate income and expense tracking is the compass that keeps your budget on course. It's not about obsessing over every penny, but understanding where your money is going. (And hey, it might even lead to a few "Aha!" moments.)

Actionable Advice:

- Track your income from all sources, including your salary, side hustles, and investments.

- Record every expense, whether it's a $3 coffee or a $300 car payment.

- Use apps or spreadsheets to make tracking simple and fun. (Who said budgeting couldn't be fun?)

3. Realistic Budget Categories and Allocations

Budget categories are like the building blocks of your financial plan, and allocating the right amounts to each is crucial. Be realistic! Allocate enough to cover your needs, but don't forget to treat yourself once in a while. (Life's too short for deprivation, am I right?)

Tips for Success:

- Use the 50/30/20 rule as a starting point: 50% needs, 30% wants, and 20% savings and debt repayment.

- Adjust your allocations based on your unique circumstances and goals. (Sorry, there's no one-size-fits-all solution.)

- Don't forget irregular expenses like annual insurance premiums or holiday gifts. (We're looking at you, Santa.)

4. The Magic of the Emergency Fund

Picture this: You're cruising along with your budget, and BAM! An unexpected expense derails your progress. It's like a scene from a financial horror movie. But fear not! An emergency fund is your superhero, swooping in to save the day.

Action Steps:

- Aim for at least $1,000 in your emergency fund.

- Prioritize keeping your fund intact, especially if you have an unstable income or high debt.

- Keep your emergency fund in a separate, accessible account. (Out of sight, out of mind.)

5. Consistent Budget Reviews (No, Seriously!)

Remember, a budget is a living, breathing document that needs regular TLC. Consistent budget reviews help you identify areas for improvement, celebrate wins, and stay on track. It's like a monthly check-up for your financial health. (And who doesn't love a clean bill of health?)

Tips for Effective Reviews:

- Schedule a monthly "money date" with yourself (or your partner) to review your budget. Mark it on your calendar and make it non-negotiable.

- Adjust your budget as needed to align with your goals, life changes, or newfound insights. (Yes, budgets can evolve too!)

- Celebrate milestones and progress, no matter how small. Every win counts!

6. Leveraging Budgeting Tools and Resources

In this digital age, we have a plethora of budgeting tools and resources at our fingertips. Embrace them! From budgeting apps and spreadsheets to blogs and podcasts, these resources can make budgeting efficient, enjoyable, and, dare we say, exciting.

Actionable Advice:

- Experiment with different tools and resources to find what works best for you.

- Don't be afraid to switch things up if your current approach isn't working. (Remember, budgeting should be a joy, not a chore.)

- Connect with like-minded individuals through online communities and friend groups for encouragement, and inspiration.

FAQs

How long does it take to see the results of budgeting?

Budgeting is a marathon, not a sprint. While you may see some immediate benefits, like reduced stress and improved awareness of your spending habits, significant results can take time. Stick with it, and you'll reap the rewards in the long run.

Can I still have fun while on a budget?

Absolutely! Budgeting isn't about depriving yourself of enjoyment. It's about making intentional choices with your money. Be sure to allocate funds for fun and entertainment, and remember that many enjoyable experiences don't have to break the bank.

How often should I adjust my budget?

Adjust your budget as needed based on your monthly reviews, changes in your financial situation, or shifts in your goals. Remember, a budget is a flexible tool designed to help you achieve financial success on your terms.

Pepper’s Takeaways

So, there you have it – these are (in my opinion) the key components to successful budgeting that'll have you dancing all the way to the bank. (Metaphorically, of course.)

The only way you are going to see financial success in this high inflation period is by having a plan. This is done by:

- Setting SMART goals

- Tracking your income and expenses

- Creating realistic categories

- Building that $1,000 emergency fund

- Conducting regular reviews

- Leveraging tools and resources

Happy Budgeting!

Comments ()