What Happens to the Stock Market During a Recession?

Recessions signify economic decline, impacting the stock market. Each market sector responds differently, with some suffering and others faring better. Government interventions can help stimulate the economy during these challenging periods.

The stock market is one of the most important indicators of the health of the economy. In times of recession, many investors wonder what will happen to the value of their investments. The answer is not straightforward, as the stock market's performance during a recession can vary greatly depending on a variety of factors.

Understanding Recessions and Their Impact on the Economy

Before delving into the effects of a recession on the stock market, it is crucial to understand what a recession is and how it impacts the economy. A recession is a significant decline in economic activity that lasts for several months or more. It is usually characterized by a decrease in gross domestic product (GDP), rising unemployment rates, and a drop in consumer spending.

During a recession, businesses may struggle to stay afloat, and many may be forced to close their doors. This can lead to a rise in unemployment, as workers are laid off and unable to find new jobs. As a result, consumer spending often decreases, as people become more cautious with their money.

Definition of a Recession

The National Bureau of Economic Research defines a recession as "a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales."

While the exact definition of a recession may vary depending on who you ask, most experts agree that it is a period of economic decline that lasts for an extended period of time.

Common Causes of Recessions

Recessions can be caused by a variety of factors, including a financial crisis, a decrease in consumer confidence, or a decrease in government spending. Most economists agree that recessions are an inevitable part of the business cycle, which is a periodic fluctuation in economic activity.

One common cause of recessions is a financial crisis, such as the one that occurred in 2008. During this crisis, many banks and financial institutions failed, leading to a significant decline in economic activity around the world.

Economic Indicators of a Recession

There are several indicators that economists use to determine if the economy is in a recession. These include real GDP, the unemployment rate, industrial production, and retail sales. If these indicators are all declining for several consecutive months, it is likely that the economy is in a recession.

However, it is important to note that these indicators are not foolproof, and there may be other factors at play that are not reflected in these numbers. For example, a decline in consumer confidence may not be immediately reflected in the unemployment rate or GDP.

Overall, while recessions can be difficult and challenging for many people and businesses, they are a natural part of the economic cycle. By understanding the causes and indicators of a recession, we can better prepare for and mitigate their impact on our economy.

Historical Stock Market Performance During Recessions

The performance of the stock market during a recession can vary greatly depending on the specific circumstances of the recession. However, there are some notable examples in history where the stock market's performance during a recession has been particularly significant.

The Great Depression

The Great Depression was a severe economic downturn that lasted from 1929 to 1939. During this time, the stock market experienced a significant decline, with the Dow Jones Industrial Average falling by over 80% from its peak in 1929. It took over 25 years for the stock market to recover to its pre-Depression levels.

The 2000 Dot-Com Bubble

The early 2000s saw the bursting of the dot-com bubble, which caused a significant decline in many technology stocks. While this recession was not as severe as the Great Depression, it did cause the stock market to decline by over 50% in just a few years.

The 2008 Financial Crisis

The most recent example of a severe recession that impacted the stock market was the 2008 financial crisis. This recession was caused primarily by a housing market bubble and the subsequent collapse of many large banks and financial institutions. The stock market declined by over 50% from its peak in 2007 and took several years to recover.

How Recessions Affect Different Sectors of the Stock Market

While the stock market as a whole may decline during a recession, some sectors may be more heavily impacted than others. Understanding how recessions affect different sectors of the stock market can be valuable for investors looking to minimize their losses or capitalize on the opportunities presented by a recession.

Cyclical Stocks

Cyclical stocks are companies whose earnings are closely tied to the overall economy. This includes companies in industries such as retail, manufacturing, and construction. These stocks tend to perform poorly during a recession, as a decrease in economic activity leads to a decrease in revenues and profits.

For example, during the Great Recession of 2008, the retail industry was hit hard as consumers cut back on discretionary spending. Companies like Macy's and J.C. Penney saw their stock prices plummet as a result.

Similarly, the construction industry suffered during the recession as the housing market collapsed. Homebuilders like PulteGroup and Lennar saw their stock prices drop significantly.

Defensive Stocks

Defensive stocks are companies that are considered less susceptible to the effects of a recession. They tend to be in industries such as healthcare, utilities, and consumer staples. These stocks often perform better during a recession as consumers continue to purchase essential goods and services.

For example, during the Great Recession, healthcare stocks like Johnson & Johnson and Pfizer held up relatively well. People still needed medications and medical services, regardless of the state of the economy.

Similarly, utility companies like Duke Energy and Southern Company saw their stock prices remain relatively stable during the recession. People still needed to keep their lights on and their homes heated, even if they were cutting back on other expenses.

Growth Stocks

Growth stocks are companies that are expected to experience above-average growth in revenue and earnings. While these stocks may perform well in a strong economy, they can be particularly vulnerable during a recession. Investors may be less willing to take on the risk associated with these stocks during a downturn.

For example, during the Great Recession, tech stocks like Apple and Google saw their stock prices decline significantly. Investors were concerned about the impact of the recession on consumer spending and advertising revenue.

Similarly, biotech stocks like Gilead Sciences and Biogen saw their stock prices drop as investors worried about the impact of the recession on healthcare spending and research funding.

Overall, understanding how recessions affect different sectors of the stock market can help investors make more informed decisions about their portfolios. By diversifying across different sectors and investing in defensive stocks, investors can help minimize their losses during a recession.

Government and Central Bank Interventions During Recessions

Recessions can be a challenging time for economies and can have a significant impact on businesses, individuals, and financial markets. In order to combat the negative effects of recessions, governments and central banks often implement measures to stimulate economic activity and stabilize financial markets.

During a recession, businesses may struggle to stay afloat, and individuals may experience job losses or reduced income. This can lead to a decrease in consumer spending, which can have a ripple effect on the economy. Governments and central banks can intervene to help boost economic activity and restore confidence in the financial system.

Fiscal Policy Measures

Fiscal policy measures involve government intervention to increase economic activity. This can include initiatives such as infrastructure spending, tax cuts, and stimulus programs. These measures can help to increase consumer spending and boost businesses, which can have a positive impact on the stock market.

Infrastructure spending can create jobs and stimulate economic growth, as well as improve the country's infrastructure. Tax cuts can also provide individuals and businesses with more disposable income, which can lead to increased spending. Stimulus programs, such as direct payments to individuals, can also help to stimulate economic activity.

Monetary Policy Measures

Monetary policy measures involve actions taken by central banks to influence the money supply and interest rates. Lowering interest rates can encourage borrowing and increase investment, which can boost economic growth. Central banks may also implement quantitative easing, which involves purchasing bonds to inject money into the economy.

Quantitative easing can help to increase the money supply, which can lead to increased lending and investment. This can help to stimulate economic growth and reduce the negative effects of a recession. Central banks may also use other tools, such as adjusting reserve requirements for banks, to influence the money supply.

The Role of Central Banks

Central banks play a critical role in managing the economy during recessions. They have the ability to influence interest rates and money supply, which can impact economic activity and the stock market. By implementing measures to stimulate economic growth and stabilize financial markets, central banks can help to limit the negative effects of a recession.

Central banks may also work to maintain financial stability during a recession. This can involve providing liquidity to financial institutions or implementing measures to prevent bank failures. By ensuring that the financial system remains stable, central banks can help to prevent a recession from turning into a financial crisis.

In conclusion, recessions can be a challenging time for economies and individuals. However, through the implementation of fiscal and monetary policy measures, as well as the actions of central banks, it is possible to limit the negative effects of a recession and stimulate economic growth.

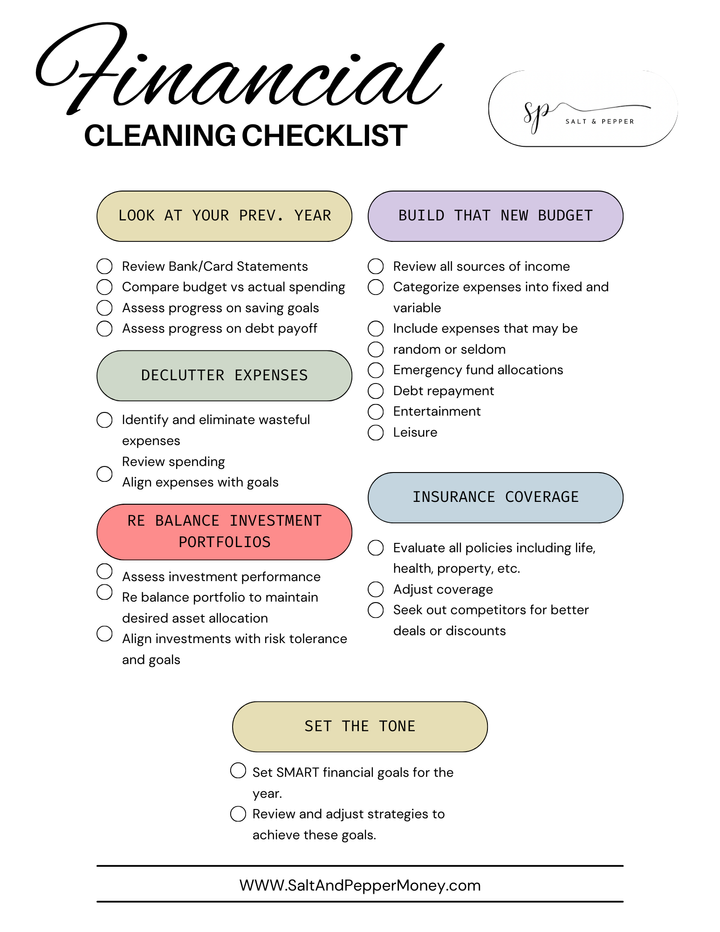

Salt & Pepper's Takeaways

While a recession can be a challenging time for investors, understanding the factors that impact the stock market's performance can help to mitigate losses and capitalize on opportunities. By paying attention to economic indicators, analyzing the performance of different sectors of the stock market, and staying informed about government and central bank interventions, investors can make informed decisions that may help to protect their investments during a recession.

Comments ()