Why is Budgeting Important?

Why is budgeting important? Budgeting is a key ingredient to financial success. Here's why.

Hey there, fellow finance-savvy folks! Pepper here, your go-to financial guru. Today, we're talking about budgeting and the budgeting process, and why it's so dang important. (Hint: it's not just because I said so, although that's a pretty good reason.)

So buckle up, grab a cup of coffee (or wine depending on the time of day), and let's dive in.

Salt & Pepper's 60-Second Summary

Short on time? No worries – Here are the key touchpoints of this post:

👉 Budgeting is crucial for financial success, regardless of your income level.

👉 A budget helps you work towards long-term goals and prepare for emergencies.

👉 Budgeting can reveal spending habits and help you break bad spending habits.

👉 Creating a budget with your partner can improve your communication and teamwork in your marriage.

👉 Budgeting can help you find financial contentment, reduce stress, and improve your quality of life.

👉 Learning how to budget effectively is key to taking control of your financial plan and achieving financial success.

Who needs to have a budget?

Short answer: everybody. Long answer: everyone can benefit from budgeting, whether you're a college student surviving on ramen noodles or a high-powered CEO bringing home the big bucks.

Here are some examples of individuals who can benefit from budgeting:

- Recent college graduates

- New homeowners

- Families with young children

- Retirees on a fixed monthly income

- Anyone with debt (so basically everyone)

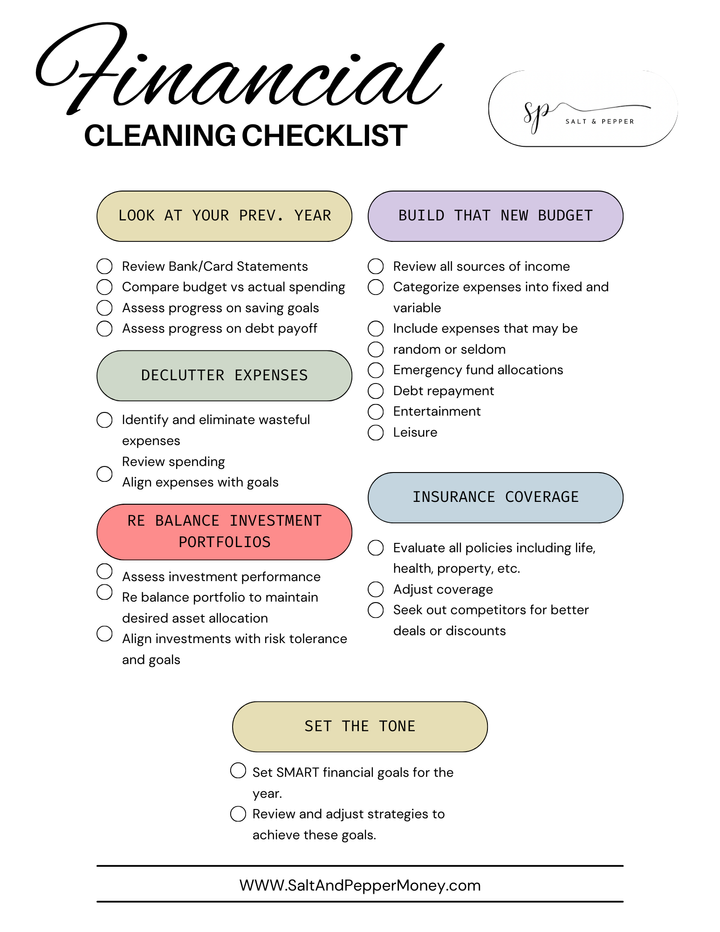

Budgeting Helps You Work Toward Long-Term Goals

Budgeting isn't just about making ends meet every month. It's also a great way to work towards long-term goals. Whether you're saving for a down payment on a house, planning for retirement, or putting away money for your kids' college education, a budget can help you get there faster. Here are some examples of long-term goals that can be achieved through budgeting:

- Paying off debt

- Saving for a down payment on a house

- Investing in a retirement fund

- Building an emergency fund

- Saving for a child's education

Budgeting Can Help with Retirement

Speaking of retirement, budgeting is an essential tool for planning for your golden years. By setting aside money for retirement every month, you can ensure that you'll have enough money to live comfortably when you're no longer working.

Budgeting Helps You Prepare for Emergencies

We all know that life can be unpredictable. From unexpected medical bills to car repairs, emergencies can happen at any time.

That's why having an emergency fund is crucial, and budgeting can help you get there. By setting aside a little bit of money every month, you can build up a safety net to help you weather any storm.

Budgeting Can Reveal Spending Habits

Have you ever looked at your bank statement and wondered, "Where did all my money go?" (If you haven't, you're either a financial wizard or you're not looking at your bank statement close enough.)

Budgeting can help you understand your spending habits and identify areas where you may be overspending. By tracking your expenses, you can make more informed decisions about where to cut back.

Budgeting Can Help You Fix Bad Spending Habits

Speaking of cutting back, budgeting can help you break bad financial habits. Do you find yourself splurging on fancy dinners or shopping sprees? Or maybe you're constantly ordering takeout instead of cooking at home.

Whatever your bad habit may be, budgeting can help you reign it in and make more responsible choices with your money.

Budgeting Can Keep You from Overspending

We've all been there: you go to the store to buy one thing, and before you know it, you've got a cart full of stuff you didn't need. (I'm looking at you, Target.) By setting a budget for yourself, you can avoid overspending and stick to your financial goals.

Budgeting Can Help Your Marriage

Money is one of the biggest sources of stress in a marriage. In fact, 35% of people believe problems in relationships are from finances.

By creating a budget together, you and your partner can work towards common financial journey and avoid conflicts about money. Plus, it's a great way to practice communication and teamwork.

Budgeting Helps You Find Financial Contentment

There's something satisfying about watching your savings account grow or paying off a credit card balance. By budgeting and achieving your financial goals, you can find contentment and peace of mind knowing that you're in control of your money.

Budgeting Keeps You From Feeling Financially Overwhelmed

Let's be real: money can be stressful. By creating a monthly budget and sticking to it, you can avoid the feeling of being overwhelmed by your finances. Plus, having a spending plan in place can help you feel more confident in your financial future and your financial life.

Budgeting Helps You Get (And Stay) Ahead

By budgeting, you can make sure you're not just keeping up with your monthly expenses, but actually getting ahead financially. Whether it's saving for retirement or building up your emergency fund, budgeting can help you achieve your financial goals and set yourself up for long-term success.

Budgeting Ensures Resource Availability

Have you ever found yourself in a situation where you needed extra money, but didn't have any on hand? By budgeting, you can ensure that you always have resources available when you need them. Whether it's an emergency fund or a savings account, having money set aside can help you avoid financial stress in the future.

Budgeting Can Lead to Financing Opportunities

When you have a solid budget in place, you may be more likely to qualify for financing opportunities like a mortgage or a car loan. Lenders want to see that you have your finances under control, and having a budget is a great way to demonstrate that.

Budgeting Provides a Pivotable Plan

A budget is more than just a list of expenses and income. It's a plan for your financial future. By creating a budget and sticking to it, you can set yourself up for success and ensure that you're on track to achieve your financial goals.

Budgeting Puts You in Control

At the end of the day, budgeting is all about taking control of your finances. By creating a budget and sticking to it, you can make informed decisions about how to spend your money and work towards achieving your financial goals.

Learn to Budget Effectively

Of course, creating a budget is one thing - sticking to it is another. If you're new to budgeting, it can be a bit overwhelming. But fear not! There are plenty of resources available to help you learn how to budget effectively. From books to online courses, there are a ton of great resources out there to help you get started.

Budgeting to Improve Your Quality Of Life

At the end of the day, budgeting isn't just about money - it's about improving your quality of life. By taking control of your finances and working towards your financial goals, you can reduce stress, find contentment, and set yourself up for long-term success.

Whether you're a college student just starting out or a retiree looking to enjoy your golden years, budgeting is an essential tool for achieving financial success. So go forth, create a budget, and take control of your finances.

Pepper's Takeaways:

Budgeting can seem overwhelming at first, but it's an essential tool for achieving financial success. Here are the main takeaways from this article:

- Everyone can benefit from budgeting, no matter their income level or financial situation.

- Budgeting can help you work towards long-term goals, prepare for emergencies, and avoid overspending.

- By creating a budget with your partner, you can improve your communication and teamwork skills in your marriage.

- Budgeting can help you find financial contentment, reduce stress, and improve your overall quality of life.

- Learning how to budget effectively is key to achieving financial success and taking control of your finances.

So what are you waiting for? Take action and start budgeting today.

Comments ()